|

From CouttsSucks.com New Balance

At the dedication of the Bank's new headquarters building at 440 Strand on December 14, 1978 Queen Elizabeth II said, "members of my family, for generations, have had to acknowledge the wisdom and prudence of the advice they have received from Coutts, even if they have not always been grateful for it. Advice is, however, always easier to accept if it is delivered with that old-fashioned courtesy for which this institution is renowned, and backed up by authority and expertise."

In his 1948 book Great Morning, the third volume of his autobiography, the poet Sir Osbert Sitwell wrote: "I must take this opportunity of thanking Messrs. Coutts & Co. for their imaginative understanding of situations and individuals, and for the support they have afforded me from time to time, ever since I was eighteen and first became their customer. But for their coming to my rescue when it was necessary, I should now be working at some job for which I possessed no aptitude. Indeed, as I have frequently assured them, they have shown me more kindness and comprehension than did my own father. When businesses were content to lose everything except their profits, this great institution kept its soul alive. Throughout three centuries, those who work in it have maintained the same name for personal kindness and personal contact and, no doubt for that reason, have numbered among their clients many grateful artists and writers. In a day when it seems popular to attack the present methods of banking, I must state my opinion and experience, and add that, to my belief, there is more of character and rectitude, enterprise and independence contained in this one ancient house than in the whole of the attacking body. Not only the chiefs, but every one of Messrs Coutts' clerks and employees, understands and takes pride in its traditions."

"The client list is confidential, but is reputed to include David Beckham, of Manchester United, and his wife Victoria. 'We see large amounts of money pouring into football. This has been a growth market for us,' Cooper said. 'Today's football stars need full wealth management advice rather than just a bank account and a credit card.'" This followed the Evening Standard article on June 7, 2001: "The bank has appointed advertising agency M&C Saatchi to run a campaign to attract new customers and modernise its image. A spokeswoman for the agency said: 'I can confirm that we have been appointed to handle Coutts but at this stage I can't say what form that advertising will take.' "Coutts, which has been famous for handling the finances of the rich and powerful for centuries, wants to change perceptions of the brand, broaden its appeal and target the new wealthy. 'We have talked to M&C Saatchi about building the Coutts brand and how to take it forward,' said a Coutts spokeswoman. Chief executive Andrew Fisher, who, as well as a background in banking, previously worked in marketing for Unilever, is credited with revitalising the bank."

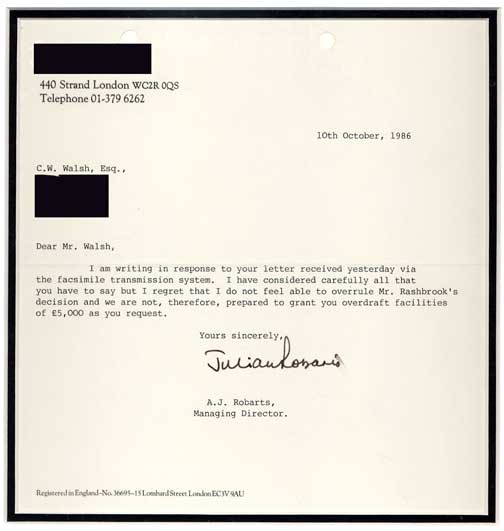

"Chris Rashbrook, the manager of Virgin's account at Coutts Bank, had hoped to avoid this meeting, but over the previous week circumstances had made an unpleasant and embarrassing task unavoidable. For some time, Coutts had been considering an application from Virgin to increase their overdraft facility above the previously agreed limit of £4 million. The previous week, Virgin had requested immediate permission to go over the facility by some £200,000, to meet short-term outgoings for the airline (to pay, in fact, for the engine which had expired on the air-operator's test flight). The application had been subject to long and disapproving scrutiny at Coutts. The bank had made no secret of their dismay over Virgin's venture into airlines. For a company with Virgin's limited borrowing power the venture seemed foolhardy, not to say suicidal --- notwithstanding Branson's protestations about 'protecting the downside.' But that was not all. In the last year Virgin had invested some £4 million in their first major film project, Electric Dreams; more money was now being poured into yet another, a new version of George Orwell's book Nineteen Eighty-four. When would it end? "Rashbrook broke the news as delicately as he could. He had come, he said, to give Branson a message. Coutts had considered Virgin's request to exceed their overdraft by £200,000 over the next seven days. And had decided to refuse it. If Virgin exceeded their overdraft by so much as £25, the cheque would, alas, be returned marked 'refer to drawer.' In a word, bounced. "'This is an absolute farce,' Branson said. Coutts had been informed that a cheque for $6 million was expected at any moment from MGM films in America --- payment for the distribution rights of Electric Dreams. The company had made a proper request to extend its facility. "'You're telling me that it's official Coutts policy to bounce a cheque on one of the ten biggest private companies in Britain?' "Rashbrook nodded silently. "Branson felt indignant. Virgin had shown a profit of more than £11 million in the last year. At an absolute minimum, the worth of the company must be £100 million (in fact, within the next two years it would be worth £250 million). And yet Coutts were threatening to bounce cheques of £25! In fact, Branson should have known it was coming. Virgin and Coutts had long been growing apart. From the earliest days of Student magazine, Coutts had indulged the idiosyncrasies of Branson's banking practices with bemused aplomb. They had raised only the most discreet eyebrow at the bedraggled urchins who queued to deposit the takings from the magazine and mail-order; at the implausible schemes for manor-house recording studios and sundry businesses of a bizzareness beyond the bank's mannered comprehension. The Bransons, after all, had banked with Coutts for generations. Richard was one of 'us' -- after a fashion. But, in recent years, the relationship had outgrown even that important bond. Virgin were now a commercial concern, trading with a flair, and a lack of convention, that tested Coutts's nerve and understanding. Such assets as Virgin had were almost meaningless: not the bricks and mortar so reassuring on the balance sheet, but the more nebulous assets of music and publishing copyrights --- tangible enough, perhaps, to people who understood the music business, and knew that at any given moment Virgin could raise millions if they so chose; less comprehensible to a bank where customers were still greeted by frock-coated doormen. [ ... ] "The prospect of changing banks had been discussed before. But changing banks, as Branson was prone to saying, 'is a bit like changing your parents for a new set. When you've been with the same bank since you were thirteen, you somehow feel they will grow up with you.' This was patently no longer the case. "Branson brought the conversation with Rashbrook to a perfunctory close. 'I'm sorry,' he said, 'but you are not welcome in my house. I'd rather you left.'" Our experience with Chris Rashbrook wasn't very different. This letter has been framed an on the wall of my den since the early 1990's:

According to Charlie Methven in the May 29, 2004 issue of the Daily Telegraph, "First it abandoned the frock coats that its staff have worn for more than 300 years. Now Coutts --- the royal bankers --- has hired modish tailor Ozwald Boateng to redesign its World Signia charge card. "'It's all part of a drive to modernise,' explains one insider. 'They're desperately trying to create a less stuffy image. It goes with the lottery winners who bank there these days.'" "When Spy calls Coutts, a spokesman is happy to elaborate. 'We're very excited about it,' he says. 'Ozwald Boateng and Coutts are actually very similar. He's got his Savile Row shop and we have 311 years of history. He's is trendy, while our biggest area of growth is with our entrepreneurial customers.'"

Michael Bowes Lyon, the Queen Mother's brother, went missing in action in during World War I and was presumed dead. According to his daughter-in-law, Mary the Dowager Countess of Strathmore, the family "was obviously very sad and worried at the death. I've always been told, but whether it's a true story I don't know, but it's a wonderful story, I think, that the first news that they had that he was alive was when Coutts Bank rang up Glamis Castle and said, 'we thought you'd like to know that Captain Michael has cashed a cheque.' He apparently cashed the Coutts cheque at a German prisoner of war camp.

According to the Western Daily Press, February 26, 2004, "They wore frock coats at Coutts Bank until five yers ago and the decor was reminiscent of an English country house. Not any more. The bank now exudes a style that is modern, subtle, cool and best of British. "And as for the frock coats, 'I would dress up as a penguin if you brought me business,' declared group chief executive Gordon Pell on a flying visit to the bank's elegant Bristol branch in Queen's Square yesterday. 'We do keep our frock coats for special occasions and if our foreign customers like to see it, we do wear them,' he added."

I suspect it goes without saying, but this site is not affiliated with Coutts & Co., nor is it endorsed by them. Their website is at http://www.coutts.com © Copyright 1998-2008 by Craig W Walsh |